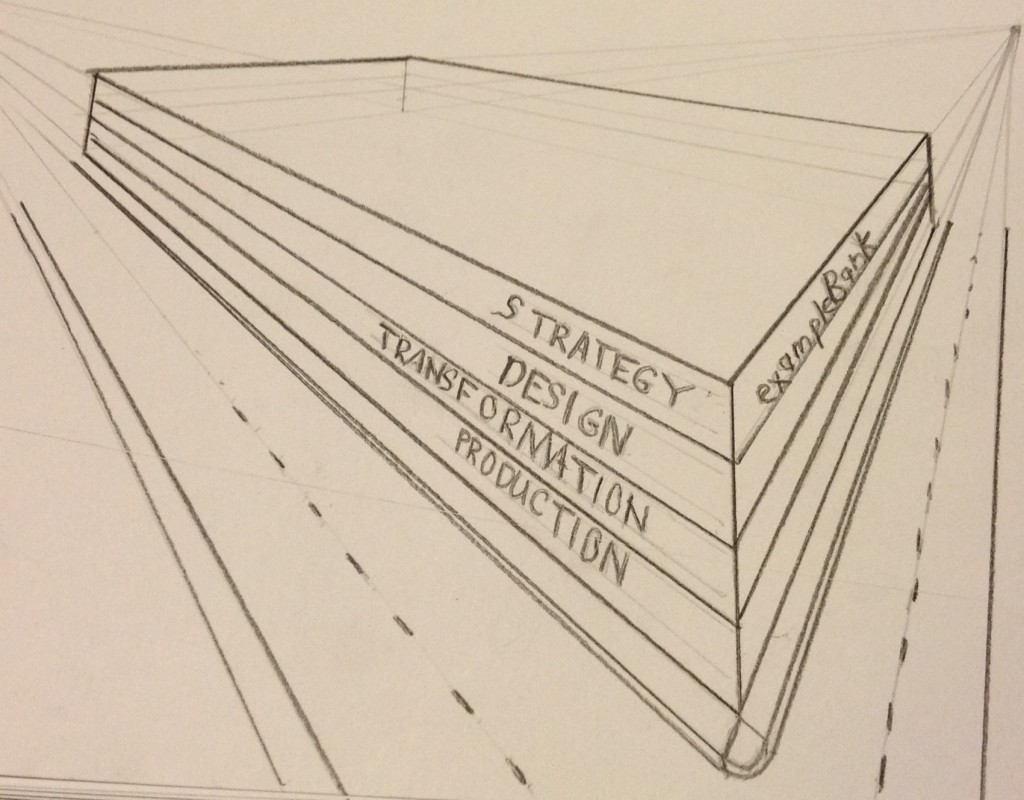

The exampleBank executive team has completed the corporate strategy for the exampleBank group. Now, they move out of the corporate strategy room and into a new room on level 4 of the HQ building that has been set aside for Consumer Banking USA, where they will develop the business strategy for that unit.

The first area of focus will be the business model as summarized below:

- Customer Segments: USA Consumers. A common service design will be provided for all consumers with niche services layered on top for customer archetypes.

- Customer Relationships:

- Channels:

- exampleBank’s primary distribution channel will be a suite of mobile apps.

- Customers will have access to exampleBank services from the ATM networks of other banks.

- exampleBank will maintain a simple yet pervasive social medial presence. It will scan social media platforms for comments. Comments on its own social media spaces will be responded to quickly. Comments outside its social media spaces (blogs, forums, etc.) will receive a more delayed response. Sentiment and response times will be measured and actively managed.

- exampleBank will provide call and chat services for support from its contact center on level 1 of the HQ building.

- Value Proposition:

- Resources:

- Activities:

- Planning activities

- Production activities:

- Contact center

- Mobile app maintenance.

- Revenue Flows:

- exampleBank’s primary revenue flow will be returns from investing account holder deposits.

- Cost Structure:

- Interest expense on account holder deposits

- Salaries for executives and management engaged in strategy, organization design, and oversight

- Salaries for employees engaged in transformation activities

- Salaries for employees carrying out production activities (see activities, above)

- Pay-per-use cloud computing expense

- Rent for HQ building

- ATM network fees

- Taxes and other government fees.

- Partnerships:

- exampleBank does not yet have an IT strategy. The tentative plan is that it will not have a data center of its own. All software will run in a private cloud. However, the specifics are to be determined.

- Loan applications will be routed to LendingPlatform.com.

- exampleBank will be an institutional investor and plans to use deposits from account holders to purchase loans from LendingPlatform.com.