The exampleBank executive team has completed a self scan of the nascent exampleBank and are ready to starting writing down the exampleBank business strategy. They have moved into the newly finished corporate strategy room on level 4 of the HQ building.

exampleBank wants to help consumers use their money wisely. By managing their own costs, exampleBank will be able to pay its customers a higher interest rate on their account balances. exampleBank offerings will only be considered if they support this mission.

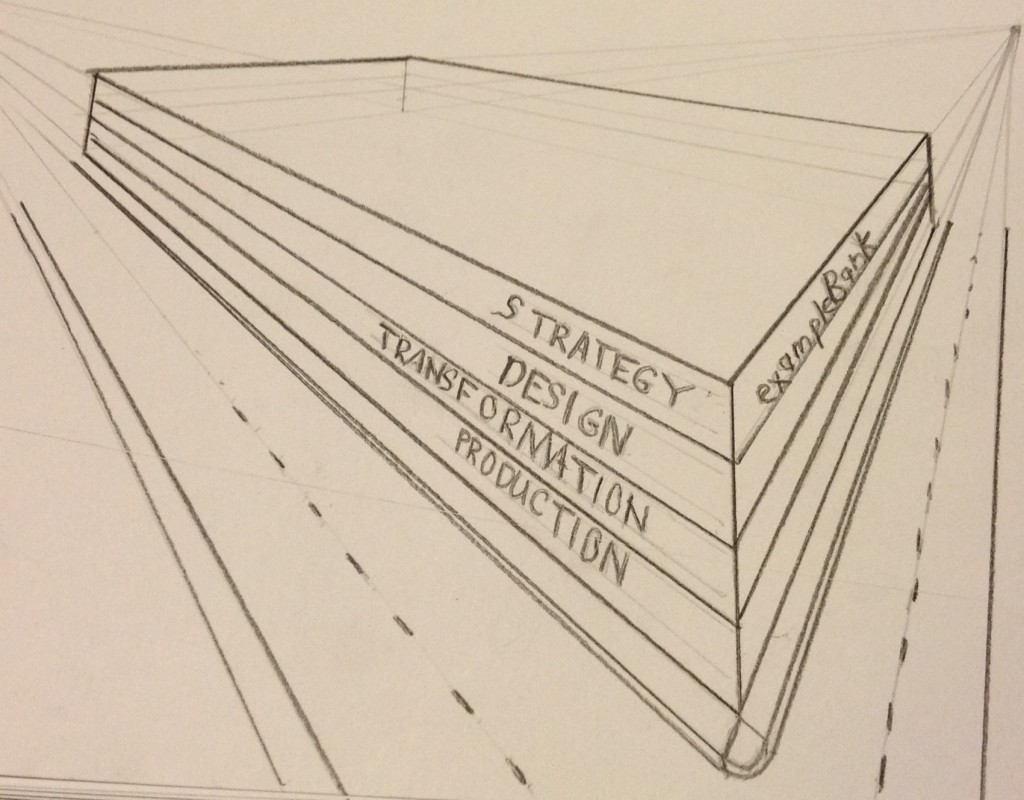

exampleBank has big plans. But given its weaknesses, it will start small and grow swiftly but carefully. exampleBank will adopt lean start-up approach to validate the assumptions in its business model. Similarly, it will adopt a learn, code, monetize approach to bring its operating model into production quickly.

The new bank’s corporate strategy will be to begin with a single business unit (exampleBank USA) providing a single product (SaveOrSpend Account) to a single customer segment (the consumer mass market). Its service design will provide basic consumer banking services.

exampleBank wants to capitalize fully on the opportunities it has identified in the market. Therefore, it will offer a reduced set of services allowing it to become a low-cost leader. No branches, ATMs or loan processing. The details will be delegated to the head of its first business unit (and owner of the respective business unit strategy).

exampleBank wants its business units to be 100% customer focused. Each business unit will focus on a major customer segment. For example, in the future exampleBank wants to create a business unit targeting the small and medium enterprise (SME). As the number of business units increase, shared services will be factored out to maximize economies of scale. The primary standardization and integration required across business units within a country will be that required to leverage shared services. It is also expected that certain corporate client actors will be private banking customers and have family members who are consumer banking customers, etc. They expect to have radically different business processes that access some common data. Within a country, business units conform to a coordination model. Details to be deferred to the operating model design.

exampleBank wants to be a global bank. It will replicate business units across countries. These business units will be standardized (so that they can be easily replicated) and integrated (so that customers can transact transparently as they travel internationally). Across countries, business units will conform to a unification model. exampleBank is betting that globalization will drive bank regulations that are more similar and allow increased data sharing and standardization across boarders. Details to be deferred to the operating model design.

Start-up operations of exampleBank have been crowd-funded. Once the business model is defined a private placement will raise the additional capital required to get the first business unit operating at a profit. At an opportune time, a public offering will provide capital to create business units for other market segments and countries.

Next on the agenda is the Business Unit strategy for the USA Consumer Banking Business Unit. In the background the executive team is also beginning to assemble the exampleBank Business Plan.

Like this:

Like Loading...

I like the name “exampleBank” and the tag line “the good example bank“. It is descriptive and a social statement at the same time!

I like the name “exampleBank” and the tag line “the good example bank“. It is descriptive and a social statement at the same time!