According to Digital Bank by Chris Skinner society now create 2.5 exabytes of data per day. An exabyte is a 1 with 18 zeroes after it, or 1,000,000,000,000,000,000 bytes.

Monthly Archives: June 2014

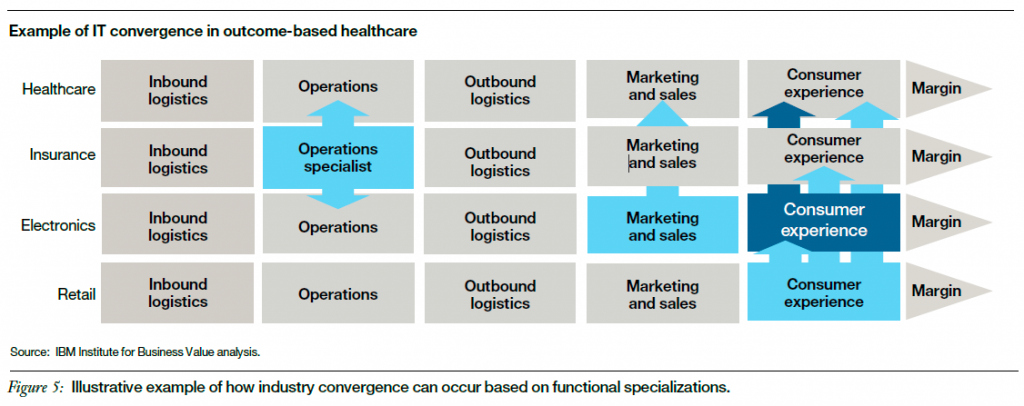

Industry Trend: Dual Strategies

“Organizations will begin pursuing dual strategies: to continue the focus on core business in their primary industries; and to seek growth opportunities in their chosen specialized functions across other industries. Specialization will drive industry convergence as competition expands around specific, common value chain functions.”

From IBM’s Digital reinvention Preparing for a very different tomorrow by Saul Berman, Anthony Marshall and Nadia Leonelli

Industry Trend: Bank White-Label Services

Accenture notes that “Google Wallet, T-Mobile, PayPal, Simple, and Moven have all relied on the “white-label” services of The Bancorp Bank to provide regulated banking services to their customers.”

See The Everyday Bank by Accenture.

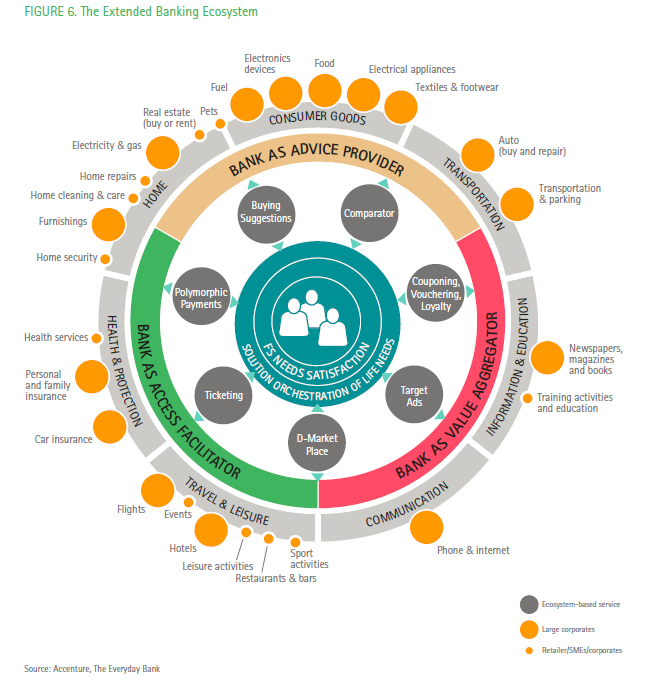

Market Trend: Banks Extending Their Reach

Customers are becoming more open-minded about banks providing services beyond traditional financial services. This includes modest extensions from providing proactive advice on spending and investing to dramatic extensions such as finding and researching products.

See the 2014 North America Consumer Digital Banking Survey study by Accenture.

Accenture comments: “In becoming an Everyday Bank, the bank evolves beyond its traditional boundaries to build a digital ecosystem with existing provider partners and other key players in areas such as home goods, health, travel and leisure, communication, and transportation. The bank customizes its offerings in these areas based on its analysis of a customer’s transaction data, and it presents these offerings in a consistent, omnichannel setting, with presale advice, discounts, post-sale support, cross-sale opportunities, and more.”

A good example of this is Cardlytics, who analyze credit card transaction data and match it to merchant offers–all without any data leaving the bank’s firewall. Offers are included in the account statement. Accenture notes that “For the customer, this is virtually effortless cash-back on day-to-day spending. One major U.S. bank has given more than $17 million back to customers through the program. Banks share in merchant commissions, which are typically in the range of 10 percent on resulting purchases.” in The Everyday Bank.

Also in The Everyday Bank, “BBVA’s acquisition of Simple, a digital U.S. bank, cast a spotlight on the new generation of personal financial management (PFM) tools, which are central to Everyday Bank‘s strategy. To help customers analyze their spending, the bank captures more than 80 transaction characteristics each time they use their debit card. By helping consumers manage and forecast day-to-day spending, these kinds of tools help drive trust, loyalty, and revenue. Whereas the average U.S. consumer visits their bank branch three times per month, Simple customers interact with the bank twice a day.”

The report has other stories about banks extending their reach including:

- a mobile app by Garanti (Turkey)

- a car-buying service by USAA (a top-30 USA bank)

- augmented reality mobile apps to help with house-hunting by Commonwealth Bank of Australia, Barclays in UK, Hana Bank in South Korea, and JP Morgan in the United States.

Market Trend: New Market Entrants

Customers are becoming more open-minded about receiving financial services from non-banks.

See the 2014 North America Consumer Digital Banking Survey study by Accenture.

Accenture estimates that “competition from digital players could erode as much as one-third of traditional retail bank revenues by 2020.”

…and notes that “Alibaba, China’s equivalent to Amazon, became the world’s fourth largest money-market fund only nine months after entering the business.”

…and “Google now offers a plastic debit card to go with its mobile wallet.”

…and “bank leaders cited ‘new market entrants’ among the three biggest risks they saw in the year ahead.”

See The Everyday Bank by Accenture.

Digital Bank points out that today non-bank providers handle over 15% of all payments worldwide, up from almost zero 10 years ago.

Deloitte observes that both sides of banks’ balance sheets are threatened by the security markets. This includes the new peer-to-peer lending services. Start-ups with experienced bank management are entering the traditional banking markets to capitalize on an expected cyclical upswing in profitability and are able to secure funding on this premise.

Market Trend: Branchless Banking

Customers are becoming more open-minded about branch-less banking. See the 2014 North America Consumer Digital Banking Survey study by Accenture.

But most still do use the branch and call center. In fact, the more they use digital channels, the more they use the physical channels. See McKinsey: The Future of U.S. Retail Banking Distribution.

What is a Customer Archetype?

Studying customers is of concern whether you are formulating a business strategy or designing a mobile app. It helps to have a clear understanding of profiles, personas and archetypes.

Archetype is hands-down the most interesting word. So let’s start there! Archetype analysis studies customers at the edges instead of looking for averages within clusters as in market segment analysis.

I enjoyed a paper by Dr. Paul Riedesel at Action Marketing Research. which contrasts archetype analysis with market segmentation.

I also found the The Future Priority Report by www.scorpiopartnership.com useful. They comment: “An archetype embodies a particular kind of behavior that is distinct and unique in some kind of way” and identify the following archetypes:

- Benefit valuers

- Wealth builders

- Status enhancers

- Convenience seekers.

The advantage of market segment analysis is that it finds segments based upon the data. They plot customers as dots on a chart based upon attributes, find clusters of dots, and draw circles around them. You guessed it, each circle becomes a segment.

As far as I can tell, people just make up archetypes. Customer attributes are then matched to the archetypes based upon data. The more the customers match an archetype, the more useful the archetype framework is. If the customer set falls well into the archetype framework then the individual archetypes can be studied and the results applied to the customers.

My own interest in archetypes stems from my own behavior which I have observed semi-consciously. I get in the middle of something and I get caught up with it. I become a different person for a time. It becomes a temporary obsession until “the job” is more-less completed. These extreme behaviors map to archetypes which are associated with key jobs that customers need to get done. By “key jobs” I mean any activity that is important enough and complex enough to become obsessed with and need help with. I am interested in the archetypes as well as the jobs that are important in the banking industry. These would include: new worker, new career holder, family oriented, investor, traveler, expat, homeowner, business owner, retiree, shopper (home, auto, other), and hobbyist. If you can think of some more, then please comment on this post!

exampleBank – Business Unit Strategy for Consumer Banking USA

The exampleBank executive team has completed the corporate strategy for the exampleBank group. Now, they move out of the corporate strategy room and into a new room on level 4 of the HQ building that has been set aside for Consumer Banking USA, where they will develop the business strategy for that unit.

The first area of focus will be the business model as summarized below:

- Customer Segments: USA Consumers. A common service design will be provided for all consumers with niche services layered on top for customer archetypes.

- Customer Relationships:

- Channels:

- exampleBank’s primary distribution channel will be a suite of mobile apps.

- Customers will have access to exampleBank services from the ATM networks of other banks.

- exampleBank will maintain a simple yet pervasive social medial presence. It will scan social media platforms for comments. Comments on its own social media spaces will be responded to quickly. Comments outside its social media spaces (blogs, forums, etc.) will receive a more delayed response. Sentiment and response times will be measured and actively managed.

- exampleBank will provide call and chat services for support from its contact center on level 1 of the HQ building.

- Value Proposition:

- Resources:

- Activities:

- Planning activities

- Production activities:

- Contact center

- Mobile app maintenance.

- Revenue Flows:

- exampleBank’s primary revenue flow will be returns from investing account holder deposits.

- Cost Structure:

- Interest expense on account holder deposits

- Salaries for executives and management engaged in strategy, organization design, and oversight

- Salaries for employees engaged in transformation activities

- Salaries for employees carrying out production activities (see activities, above)

- Pay-per-use cloud computing expense

- Rent for HQ building

- ATM network fees

- Taxes and other government fees.

- Partnerships:

- exampleBank does not yet have an IT strategy. The tentative plan is that it will not have a data center of its own. All software will run in a private cloud. However, the specifics are to be determined.

- Loan applications will be routed to LendingPlatform.com.

- exampleBank will be an institutional investor and plans to use deposits from account holders to purchase loans from LendingPlatform.com.

How to Read My Blog

First, thank you for stopping by my blog. I hope it is as useful to you as it is to me. I use it daily for a personal reference as well as a place to refer colleagues and clients, which is why it is essentially a network of useful facts and (perhaps more importantly) references. You are reading my personal notes that I use to carry out my daily activities.

My blog posts are organized into categories and series. The categories are very broad and map to the menu on my blog. A series is a more focused group of posts that link together in sequence and can be read more-less like a book.

I am currently blogging about digital banking build vs. buy decisions.

A recent tangent (for a client in the UK) was a top-down summary of cloud computing related reference architectures.

The index below provides an entry point to my blog series so that I don’t forget about them and you can find them.

These links take you to the first post in the series and this is good because you can see the series index, get a feel for what is covered in the series, and go directly to what you are most interested in.

- Doing Strategy where I talk about the strategy process as I see it.

- Trends where I look at technology, industry and market trends that must be considered as part of an environment scan in a strategy process relevant to the banking industry.

- Forces where I look at market, industry and macro-economic forces that must be considered as part of an environment scan in a strategy process relevant to the banking industry. (just starting this series)

- Strategic Technologies where I inventory the technologies most frequently required to implement bank strategies.

- Strategic IT Capabilities where I inventory the capabilities IT groups need to have to implement common strategies.

- Strategic Business Capabilities (soon) where I inventory the capabilities financial services providers typically require to be competitive.

- exampleBank Business Strategy where I build a bank floor-by-floor as an example of leveraging strategies, operating models, architectures and technologies.

- Defining Words where I look at words that I thought that I understood but didn’t for the benefit of those that think they do but don’t (or didn’t know they needed to).

Other good places to start:

- Strategy: How it all fits together where I provide my own high-level end-to-end process which I use when developing and implementing an IT strategy

- Why This Blog? where I explain why I take the time to do all of the above

- Reading List Summary in case you want to see what I have been reading lately.

exampleBank – Corporate Strategy

The exampleBank executive team has completed a self scan of the nascent exampleBank and are ready to starting writing down the exampleBank business strategy. They have moved into the newly finished corporate strategy room on level 4 of the HQ building.

exampleBank wants to help consumers use their money wisely. By managing their own costs, exampleBank will be able to pay its customers a higher interest rate on their account balances. exampleBank offerings will only be considered if they support this mission.

exampleBank has big plans. But given its weaknesses, it will start small and grow swiftly but carefully. exampleBank will adopt lean start-up approach to validate the assumptions in its business model. Similarly, it will adopt a learn, code, monetize approach to bring its operating model into production quickly.

The new bank’s corporate strategy will be to begin with a single business unit (exampleBank USA) providing a single product (SaveOrSpend Account) to a single customer segment (the consumer mass market). Its service design will provide basic consumer banking services.

exampleBank wants to capitalize fully on the opportunities it has identified in the market. Therefore, it will offer a reduced set of services allowing it to become a low-cost leader. No branches, ATMs or loan processing. The details will be delegated to the head of its first business unit (and owner of the respective business unit strategy).

exampleBank wants its business units to be 100% customer focused. Each business unit will focus on a major customer segment. For example, in the future exampleBank wants to create a business unit targeting the small and medium enterprise (SME). As the number of business units increase, shared services will be factored out to maximize economies of scale. The primary standardization and integration required across business units within a country will be that required to leverage shared services. It is also expected that certain corporate client actors will be private banking customers and have family members who are consumer banking customers, etc. They expect to have radically different business processes that access some common data. Within a country, business units conform to a coordination model. Details to be deferred to the operating model design.

exampleBank wants to be a global bank. It will replicate business units across countries. These business units will be standardized (so that they can be easily replicated) and integrated (so that customers can transact transparently as they travel internationally). Across countries, business units will conform to a unification model. exampleBank is betting that globalization will drive bank regulations that are more similar and allow increased data sharing and standardization across boarders. Details to be deferred to the operating model design.

Start-up operations of exampleBank have been crowd-funded. Once the business model is defined a private placement will raise the additional capital required to get the first business unit operating at a profit. At an opportune time, a public offering will provide capital to create business units for other market segments and countries.

Next on the agenda is the Business Unit strategy for the USA Consumer Banking Business Unit. In the background the executive team is also beginning to assemble the exampleBank Business Plan.