Strategic guiding principles are derived from experience, situational or positional analysis, or from researching best practices and industry or technology trends.

For example, an IT strategist for an organization might read in an analyst report that dramatically fewer banks are providing mobile apps for Blackberry devices and create the following guiding principles:

- Reduce general investment in mobile apps for Blackberry devices

- Provide for a spike of short-term investment in targeted mobile functionality that might cause profitable under-served Blackberry users to switch banks

- Reduce investment in IT capabilities for Blackberry app development. Move to outsource Blackberry app development and operations.

In the above example, the strategy is to:

- Save money by narrowing the investment in Blackberry apps

- Exploit an opportunity created by an emerging under-served segment of die-hard Blackberry users.

These kinds of strategic principles are created to guide changes to the operating model and assess the operating model against the business and IT strategy. I cover my views on these and other kinds of strategic guiding principles here.

Market research or organizational experience must confirm the existence of customer micro-segment(s) that can be engaged with this strategy and the micro-segment must be abstracted into a set of personas or archetypes.

Service design (i.e. a customer journey map) must have uncovered usage scenarios where certain features are valuable to these targeted Blackberry users. The strategy must be presented to diverse stakeholders in a manner in which they can fully absorb it and their input must be incorporated back into the strategy.

The entire strategy is based upon assumptions about technology and the environment which, assuming they are true at all, might change drastically and quickly.

My point is, guiding principles lack the richness to function as a strategy. Guiding principles are one output of a strategy process which help to guide and assess the strategy implementation process, but they are not a strategy in and of themselves. If you have not documented the strategy, then you can not assess the principles. They are just rules devoid of rationale which, themselves, introduce new risks to the organization if not incessantly questioned, defended and tweaked.

Take, for example, the motherhood guiding principle: “Provide access to all banking services consistently across all channels“. By itself the principle is difficult to envision or question. Do we expect full mortgage application submission to be a popular feature on ATM? Are our ATM interfaces not already daunting enough? How will a hurried queue of customers feel if they cannot get cash because someone is laboring through a mortgage application on the only ATM in the area? What is the strategic thinking and what competitive advantage are we expecting to materialize? How can a broad set of stakeholders envision the target state and provide feedback based upon their unique knowledge and experience?

Like this:

Like Loading...

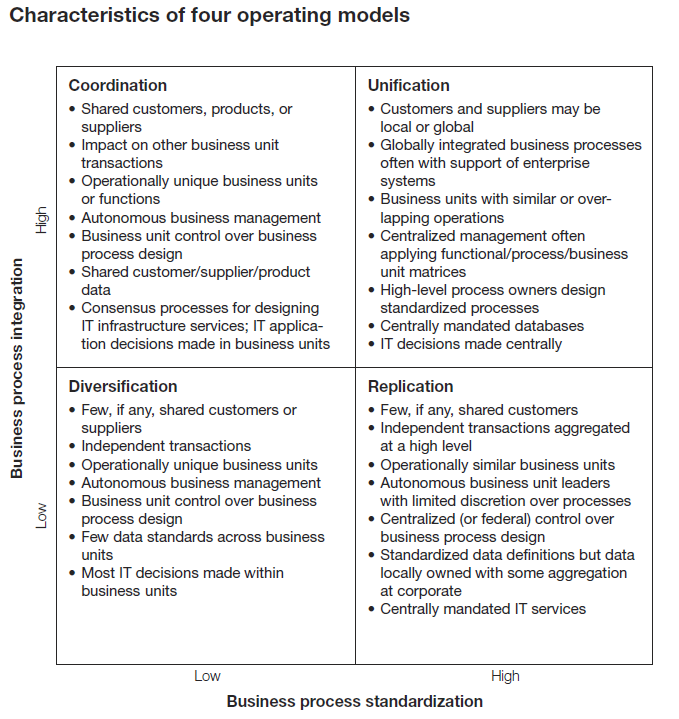

integration.

integration.