A potential trend is one of those things that I hear about every day in the news but don’t actually see any evidence of yet. If it is a potential industry-led change such as mobile wallets then the industry is spending loads of money on it but so far zero revenue. If it is a potential market-led change such as mass genome mapping then people are waiting for it but it has so far not materialized–most likely because the technology is not quite there yet. If it is a technology-led change such as the internet of things then everyone is predicting that it will happen because it is possible but so far it has not.

You should do two things:

- Put it on your watch list. Scan the news to see if it is crossing the threshold from a potential trend to something that is causing change.

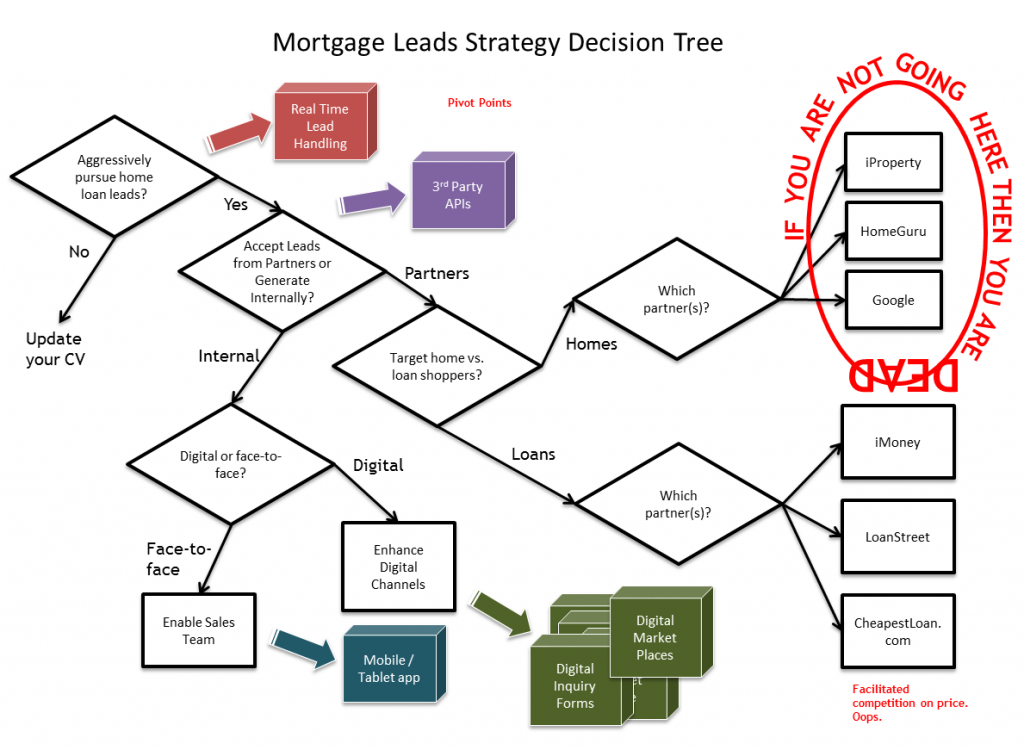

- Establish pivot points in your strategy. See my post The Bank Finds You. See the pivot points in the decision tree? These are actions that you can take now that will pay off even if the potential trend never actually materializes (or if you decide not to act) because they are relevant to more than one trend (or decision).