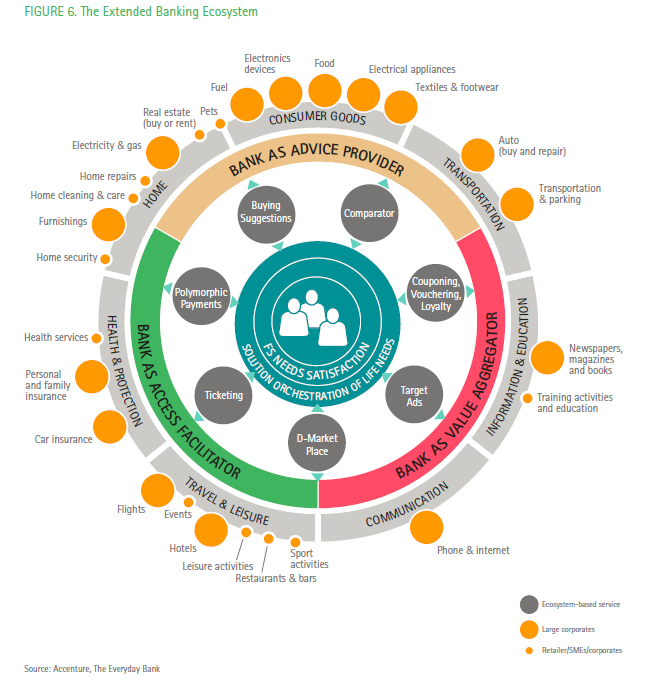

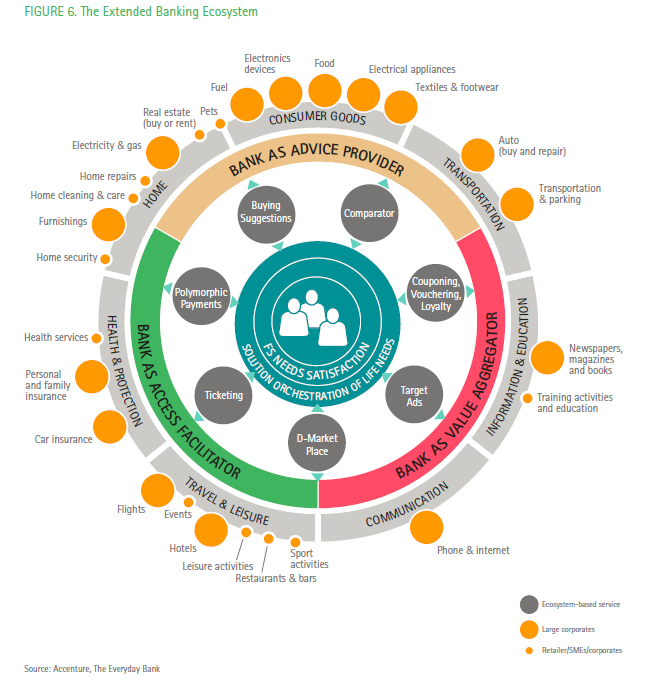

Customers are becoming more open-minded about banks providing services beyond traditional financial services. This includes modest extensions from providing proactive advice on spending and investing to dramatic extensions such as finding and researching products.

See the 2014 North America Consumer Digital Banking Survey study by Accenture.

Accenture comments: “In becoming an Everyday Bank, the bank evolves beyond its traditional boundaries to build a digital ecosystem with existing provider partners and other key players in areas such as home goods, health, travel and leisure, communication, and transportation. The bank customizes its offerings in these areas based on its analysis of a customer’s transaction data, and it presents these offerings in a consistent, omnichannel setting, with presale advice, discounts, post-sale support, cross-sale opportunities, and more.”

A good example of this is Cardlytics, who analyze credit card transaction data and match it to merchant offers–all without any data leaving the bank’s firewall. Offers are included in the account statement. Accenture notes that “For the customer, this is virtually effortless cash-back on day-to-day spending. One major U.S. bank has given more than $17 million back to customers through the program. Banks share in merchant commissions, which are typically in the range of 10 percent on resulting purchases.” in The Everyday Bank.

Also in The Everyday Bank, “BBVA’s acquisition of Simple, a digital U.S. bank, cast a spotlight on the new generation of personal financial management (PFM) tools, which are central to Everyday Bank‘s strategy. To help customers analyze their spending, the bank captures more than 80 transaction characteristics each time they use their debit card. By helping consumers manage and forecast day-to-day spending, these kinds of tools help drive trust, loyalty, and revenue. Whereas the average U.S. consumer visits their bank branch three times per month, Simple customers interact with the bank twice a day.”

The report has other stories about banks extending their reach including:

- a mobile app by Garanti (Turkey)

- a car-buying service by USAA (a top-30 USA bank)

- augmented reality mobile apps to help with house-hunting by Commonwealth Bank of Australia, Barclays in UK, Hana Bank in South Korea, and JP Morgan in the United States.

Like this:

Like Loading...