- Trends: What do we look for?

- Technology Trend: Cloud Computing

- Industry Trend: Unbundling of banks – Lending Club

- Regulatory Trend: Deregulation – RBI granting banking licenses

- Industry Trend: Immediate everything – Payments

- Market Trend: Branchless Banking

- Market Trend: New Market Entrants

- Market Trend: Banks Extending Their Reach

- Industry Trend: Bank White-Label Services

- Industry Trend: Dual Strategies

- Societal Trend: Exploding Data

- Technology Trend: Banking API’s

- Market Trend: Digital Natives

- Market Trend: Mobile Adoption

- Technology Trend: Digital KYC

- Potential Technology Trend: Internet of Things

- Industry Trend: The Bank Finds You

- Potential Industry Trend: Mobile Wallets Replace Cards

- Industry Trend: Social & Mobile Payments

- Industry Trend: Virtual Currencies

- Industry Trend: Social Finance

- Technology Trend: Big Data

- Potential Industry Trend: Bank as Data Manager

- Technology Trend: WiFi Availability

- Technology Trend: Fast Cycle of Consumer Technology

- Technology Trend: Biometric Authentication

- Industry Trend: Social Servicing

- Industry Trend: Social Reputations

- Market Trend: Increased Substitution with Capital Markets

- Industry Trend: Aggregator / Comparison Sites

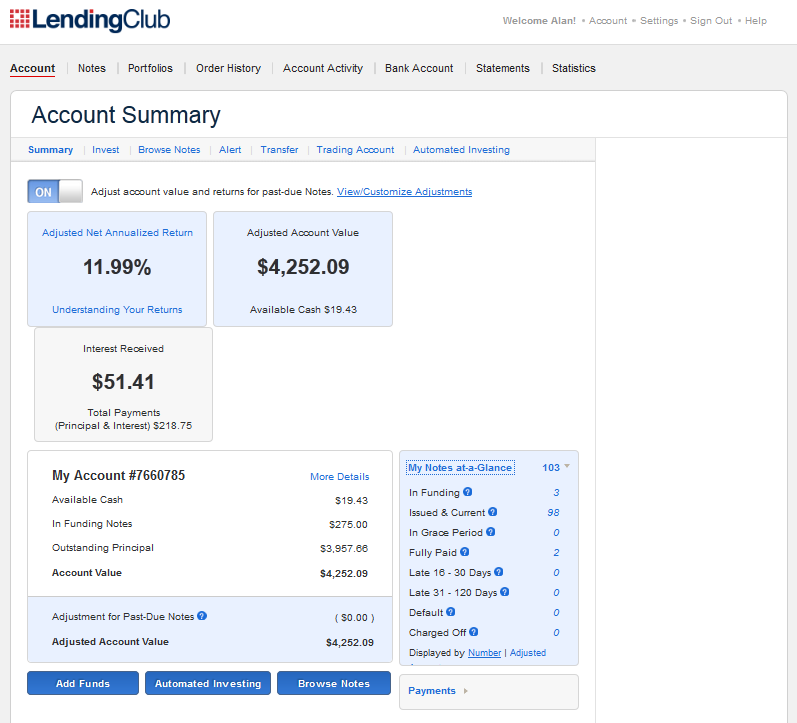

I am a big fan of Lending Club. I started investing some money there about a year ago to learn about it and couldn’t help myself from funding a few new loans each month. It is addictive! Before I know it I had saved a few thousand dollars.

So far I have not had any non-performing loans so the returns are very good. As soon as a loan goes south the returns will become very bad. Until then, I am hooked.

I would classify Lending Club as a Two-Sided Market business model. They provide the platform and bring together investors and borrowers.

I would classify Lending Club as a Two-Sided Market business model. They provide the platform and bring together investors and borrowers.

Lending Club recently sold Union Bank loans. Is this the unbundling of banking? Or just Union Bank trying to compete with me?

The Financial Times reported that in mid-2013 the US lenders Titan Bank and Congressional Bank announced that they would begin facilitating personal loans through Lending Club.

Consumers are becoming more open-minded about receiving financial services from non-banks. See the 2014 North America Consumer Digital Banking Survey by Accenture.

Digital Bank notes that:

- “FIDOR is nibbling away at the core deposit model of banks, as are Moven, Simple, Alior et al. FIDOR Bank, in Germany, manages both virtual and real currencies. FIDOR takes value from World of Warcraft and Diablo, along with gold, silver and euro funds.

- Zopa is nibbling away at the credit markets, as are smava, Prosper, Lending Circle et al. Zopa now controls about 2% of the UK personal credit market, managing about £200M.

- Currency Cloud is nibbling away at the cross-border activities of banks, as are Bitcoin, Azimo, KlickEx et al.

- Kickstarter is nibbling away at the commercial banking operations of banks, as are Receivables Exchange, Funding Circle et al.

- eToro is nibbling away at the investment operations of banks, as are ZuluTrade, StockTwits et al.“

More on this in Industry Trend: Social Finance.

Pingback: exampleBank – Trends | Alan Street

Pingback: Strategy: How it all fits together | Alan Street

Pingback: exampleBank – Forces | Alan Street

Pingback: exampleBank – Business Unit Strategy for Consumer Banking USA | Alan Street

Pingback: Industry Trend: Social Finance | Alan Street

Pingback: Technology Trend: Cloud Computing | Alan Street

Pingback: Reading List: Deloitte. Banking Disrupted – How technology is threatening the traditional European retail banking model | Alan Street

Pingback: Market Trend: Increased Substitution with Capital Markets Products | Alan Street