I have been wondering what to say about big data in banking. I have heard of some projects here and there but not seen much of a trend.

I was reading Digital Bank and found this about what banks are doing with Big Data:

“Most are not talking publicly about how they use customer transaction data as a competitive weapon because it is exactly that— a competitive weapon. Visa is one of the exceptions, saying that it can now analyze two years’ worth of customer transaction records, or 73 billion transactions amounting to 36 terabytes of data, in 13 minutes using cloud computing . This would previously have taken a month with traditional methods of internal computer processing.“

On the other hand this reminds me of a project I did when I was 17 years old. That was a long time ago! My good friend Jim at Cooper Aerial in Las Vegas needed help processing loads of contour map data. His team created digital contour maps by using stereoscopic aerial photographs to digitize 3D coordinates with a stereoscope. They needed to process this data in hours but it was taking days-to-weeks using their CAD software. I wrote a program in BasicA on one of my Dad’s PC’s that indexed the data such that it could quickly be accessed to do the processing they needed. We got the time down to about 90 minutes. Was this a big data problem? No. There was a lot of data, but it was all similar, structured, quality data. This was my first great software development project and my début as an independent consultant, but it was not a big data project.

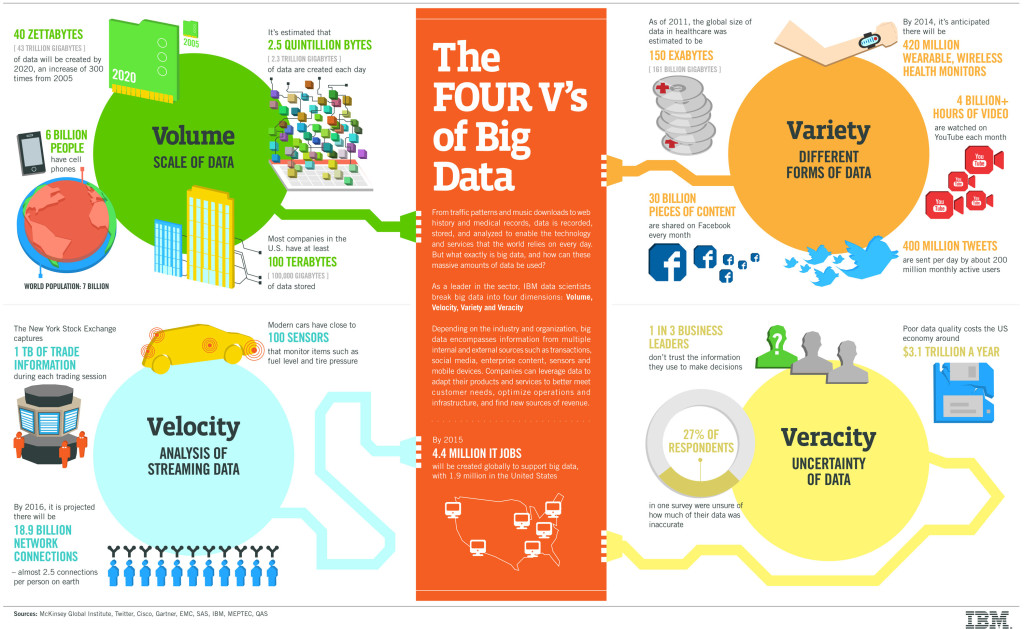

So not all big data is Big Data. IBM defines Big Data as data having multiple characteristics: Volume, variety, velocity, [lack of] veracity. See the IBM info-graphic below…

Unless Visa is, like other big banks, downloading Google searches to determine that a payment to Ying’s Wings is a purchase at a Chinese restaurant, or introducing some other unstructured data, or processing the data in real time, then it is an impressive application of analytics, but might not contribute to a big data trend.

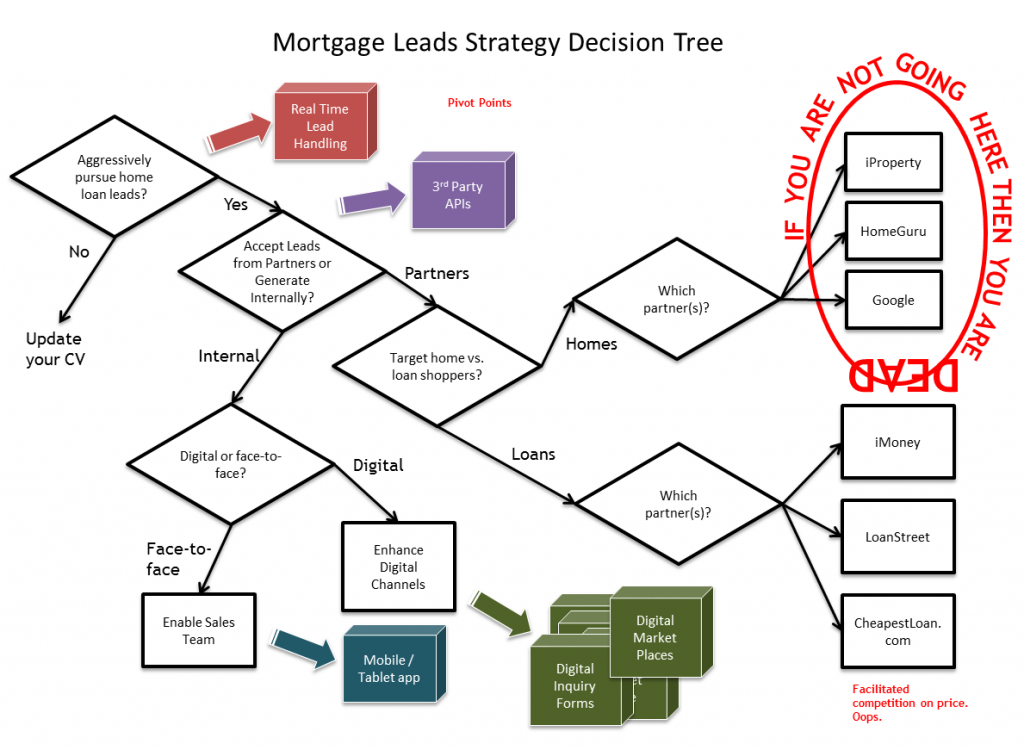

See the AWS Case Study: Bankinter for another banking big data example, this time with credit simulations.

Like this:

Like Loading...