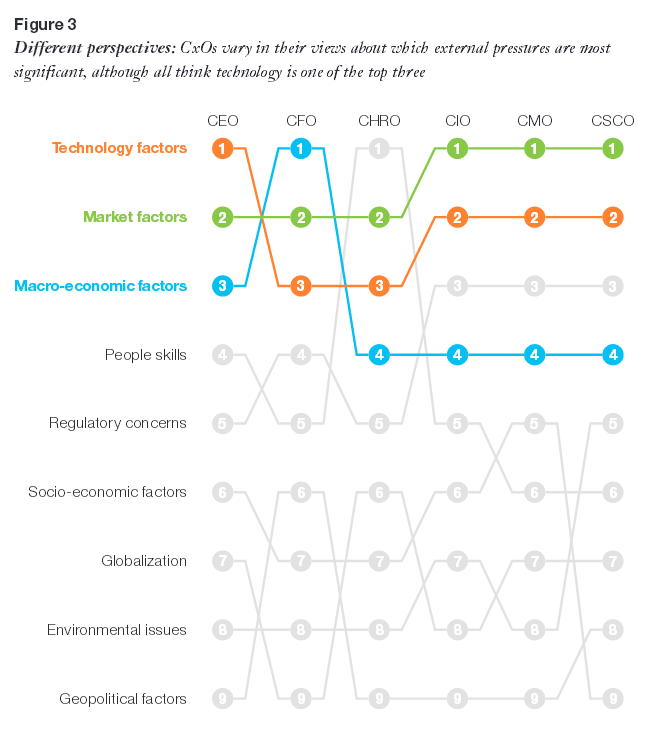

Technology is top-of-mind in the C-suite according to the IBM C-Suite Study of 2013.

Monthly Archives: December 2013

Breaking the glass ceiling for Architects

With technology top-of-mind in the C-Suite, I can not think of a profession that is growing in importance more quickly than architecture. By that I mean enterprise and IT architecture. Architects provide the technology leadership for an enterprise. Yet, architects too often get stuck together into an “architecture” organization which over time becomes less relevant to the enterprise. It is as if the important people in the enterprise want to insulate themselves from these architects. One has to wonder: Is it because the architecture team is not trusted as the most competent source of technology leadership for the enterprise, or is it because they have failed to prove that they know how to apply their vast knowledge of technology to its benefit? Whatever it is, it is a problem both for the architects and the enterprise. Why does this happen and how do we fix it?

I assume that you are an architect and I want to give you an answer that you can act on. So I am not going to bother you with ideas like “assign every architect to a cross-functional team”. I want to give you answers that you can act on immediately.

Furthermore, I will give you the benefit of the doubt: I will assume that you are competent on the areas of business and IT that are most critical to the leaders of the enterprise where you work.

What’s left is communication. I strongly believe that communication has been a limiting factor for me for most of my career. I am still working hard to improve my communications skills. Read on if you think it is also of importance to you. I will give a hint on two main points and expand on them more in future posts and revisions to this post. All I want to give you today are the short version of the answers and the source where you can learn more about the answers yourself.

The first point is that every communication needs to be relevant to the reader. If your reader cares a lot about the “why” of something and you always seem to focus on the “what” then that breaks the first rule of a good communication–providing an answer to a question that is already on their mind. The second point is to structure your communications so that, once you have the reader’s attention, the reader can easily comprehend your message.

The Pyramid Principle is a book that was recommended to me by a mentor. As I read it I see that it addresses both of the above points about communication. There are two versions of the book (both by Barbara Minto) and I honestly do not know which one is better:

I happened upon the latter in a bookstore here in Kuala Lumpur so that is the one I am reading now.

What is Cloud Computing?

Even if you already know about cloud you should watch this video by Stephen Fry!

Cloud is a broad topic about new ways to gain significant business advantage by reorganizing computing infrastructure, tools, applications and processes in a way to increase business agility and lower costs. Traditional IT infrastructure and software services are formalized and provided in a more mechanized and efficient manner. Cloud Computing is also an important trend.

The primary sub-topics are:

- Infrastructure as a Service (IaaS) – Hardware such as raw compute power and storage, virtual machines, operating systems, execution platforms such as Java application servers, database management systems, etc. Read more about IBM IaaS here.

- Platform as a Service (PaaS) – Primarily a service for IT and especially for software developers. Provides the ability to quickly build and compose software components. This is where DevOps sits. Read more about IBM BlueMix and Cloud MarketPlace.

- Software as a Service (SaaS) – Applications in the cloud such as CRM, email, games,

- Process as a Service (PBaaS) – Ranges from providing Business Process Manager (BPM) software as a service to end-to-end enablement of a business process such as account opening.

Cloud service may be provided internally, externally or both (hybrid). A large organization such as a bank might want to manage its own cloud if it believes that it can better provide for security and disaster recovery.

IBM’s view on cloud computing is captured in its Cloud Computing Reference Architecture (CCRA).

Another important area of cloud computing is cloud standards.

What is a Banking Multi-Channel Architecture?

I was referred by a client to a good article by a fellow IBMer on the subject of multi-channel architectures in banking so I though I would pass it along.

Finding the balance between reusing components and maintaining flexibility and agility on each channel is a subject that I spend a lot of time on myself and find quite interesting. This article covers the fundamentals you need to understand before tackling more complex topics.

If you are here then you must be interested in the topic. I encourage you to give it a read.

A MULTI-CHANNEL SYSTEM ARCHITECTURE FOR BANKING by Chris Pavlovski

What is DevOps?

One area of business strategy growing in importance is strategy around the business of IT. I think of “the business of IT” as how IT delivers services internally vs. IT Strategy which is (how I use the term) how IT directly supports business capabilities.

A über topic in the business of IT is DevOps. It is on my radar because it supports key business capabilities such as ability to bring new product features to market quickly and the ability to experiment with customers through continuous innovation. I will leave finding how I just contradicted myself as an exercise for the reader.

I am creating dozens of hooks for future blog posts here!

Wikipedia says: “DevOps (a portmanteau of development and operations) is a software development method that stresses communication, collaboration and integration between software developers and information technology (IT) professionals.[1] DevOps is a response to the interdependence of software development and IT operations. It aims to help an organization rapidly produce software products and services”

I really enjoy hearing about how leading practices are used in real life by small cutting-edge enterprises, but these disclosures are rare. I stumbled upon a great write-up on how iProperty has implemented DevOps on Andy Kelk’s blog. Andy says: “DevOps is to operations what Agile is to software development. It’s about increasing communication, collaboration and achieving results as a team and not in silos.” He also recommends a few books which will no-doubt end up on my reading list in the future.

What is the best mobile strategy for large banks?

The first thing that I can say about mobile strategy for large banks is that I can not cover it sufficiently in a blog post. Like business strategy, we will need to peel it back layer-by-layer.

In any kind of IT strategy investigation I recommend step 1 be a diligent survey of reading material and this usually involves lots of books, articles and analyst reports. So let’s get started with Gartner Magic Quadrant for Mobile Application Development Platforms, 7 August 2013 ID:G00248487. I believe that you can access this one for free!

Building a business case for investments in customer experience

Good news! I found another great resource for connecting customer loyalty to customer experience!

Forrester: The Business Impact Of Customer Experience, 2012.

A comment in the first paragraph sums it up: “Years of Forrester data confirm the strong relationship between the quality of a firm’s customer experience (as measured by Forrester’s Customer Experience Index [CXi]) and loyalty measures like willingness to consider the company for another purchase, likelihood to switch business, and likelihood to recommend.”

But it raises two questions:

- What is the CXi and what does it measure?

- How does this translate into cash?

The CXi measures: (still looking into this one).

The financial payoff breaks down into the following:

- Additional purchases from existing customers

- Cost reductions from lower customer churn

- New customers resulting from referrals.

A customer with a bank having an above-average CXi score is 12% more likely to consider another purchase than with a bank having a below-average customer experience score. Conversely, the above-average bank is 12% less likely to have a customer defect. The above average bank is 15% more likely to have customers recommend the bank to friends. The competitive advantage is even more positive for credit card issuers.

For U.S. banks, the annual revenue boost can be up to $252M. They provide a spreadsheet so you can customize this calculation.

I am not going to beat the drum for strategic design again but you can read about the benefits here if interested.

Connecting customer loyalty to improved customer experience

One of the most important issues I deal with regularly is how to estimate the business benefits of improving customer experience.

One good source that I turned up is IDC’s Business Strategy: Digital Services Impact on Customer Retention and Acquisition resulting from customer and bank surveys in Europe and the U.S. An interesting idea is the link between the usage level of digital channels and the customer’s satisfaction with that channel. I would have guessed that such a correlation exists and the IDC report supports a darn-near linear relationship. I like the idea of using the usage level of your mobile app as an approximate measure of customer satisfaction with the mobile channel and as a component of overall customer satisfaction.

They add that the low adoption rates indicate that the banks have failed to design the mobile apps from the customer’s perspective — a strong argument for taking a strategic design approach, in my view. They point out specific areas where their research indicates banks should focus, such as new-account-opening and chat. Security and convenience are listed as the most important factors to customers.

An approach to determining what someone needs in order to stay (that frequently works) is to ask them. According to customers: “In all countries, over 80% of respondents felt that digital services were either very or somewhat important in keeping them as a client. In Germany, that number was over 90%.” In fact, 14% of respondents said that they had closed an account because of poor/missing digital services.

If you are considering investing in digital channels as a means to improve customer experience then you are not alone. Nearly 80% of the banks in the U.S. have this strategy.